The Qatari sovereign wealth fund is worth more than 100 billion the 14th largest in the world behind those of such countries as Abu Dhabi China Kuwait and. Qatar Financial Centre Regulatory Authority.

Qatar Investment Authority Crunchbase Investor Profile Investments

Qatar Investment Authority QIA Qatar.

Qatar investment authority assets under management. Qatar UAE and 3 more. Qatar through its investment arm Qatar Investment Authority has also been making strategic investments both in Qatar. We believe it is possible to create a more sustainable world through responsible investment.

The main focus of the QFC was asset management reinsurance and captive insurance. Credit Suisse and the Qatar Investment Authority QIA are pleased to announce that QIA will partner with Credit Suisse Asset Management to form a multibillion dollar direct private credit platform that will provide financing primarily in the form of secured first and second lien loans to upper middle-market and larger companies in the US and Europe. A food company owned by the 65 billion Qatar Investment Authority QIA has launched a joint venture in Sudan as part of its strategy to generate profit and secure food supply by investing in overseas agricultural businesses.

The QIA has about 320 billion in assets according to the Sovereign Wealth Fund Institute. The general rule under Article 21 of the Foreign Investment Law is that non- Qataris whether natural or juristic persons. The latest capital market report issued by the Qatar Financial Centre QFC indicates that Qatars asset management industry is showing fast growth with assets under management AuM estimated at USD 196 billion at the end of 2019.

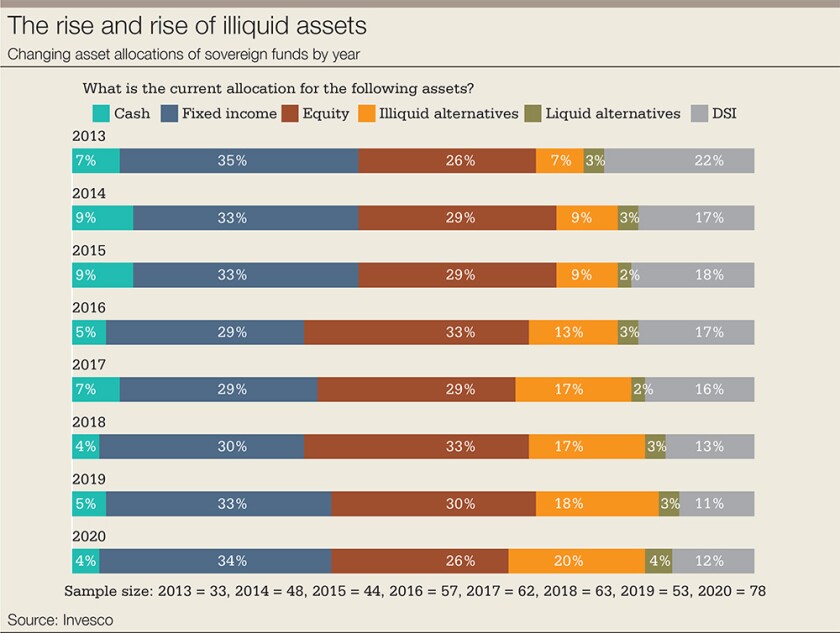

It was founded in 2005 to manage the oild and natural gas surpluses by the Government of Qatar. Middle Eastern sovereign wealth funds are looking to play a larger role in the diversification of their economies and are stepping up investments amid the coronavirus pandemic. QIAs mission is to invest manage and grow Qatar.

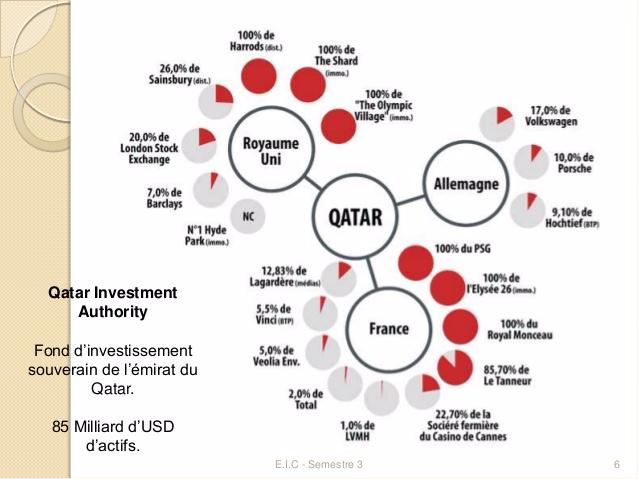

This enables effective portfolio management for assets that follow similar industry or market cycles and strengthens QIAs capability to deliver superior and sustainable risk-adjusted returns. Aviation Finance Developed tax and legal groundwork to promote QFC as platform for Aviation Finance with interest from international Aircraft lease companies to set up at QFC. It owns stakes in companies ranging from commodities giant Glencore Plc to British lender Barclays Plc.

The asset management sector is fast growing in Qatar with the industrys Assets under Management AuM totalling an estimated 196bn at the end of 2019. QIA strongly believes in superior insight through deep specialization and market access. Abu Dhabi Investment Authority.

Current Assets for QIA is 295200000000 and SWFI has 27 periods of historical assets 66 subsidiaries 284 transactions 26 OpportunitiesRFPs 137 personal contacts available for CSV Export. Hong Kong Monetary Authority Investment Portfolio. The Qatar Investment Authority QIA is Qataris Sovereign Wealth Fund specializing in domestic and foreign investments.

Our teams of sector specialists put capital to work all over the globe. The Active Investment Teams are organized along industry sectors. The Qatar Investment Authority QIA is a government-owned entity charged with managing the sovereign wealth fund of Qatar.

The Abu Dhabi Investment Authority Qatar Investment Authority and Kuwait Investment Authority are well-entrenched with billions of assets under. 102 rijen Kuwait Investment Authority. He has 30 years experience as a financial.

The QIA manages about 300 billion of assets and ranks as the 11th largest globally according to the Sovereign Wealth Fund Institute. Qatar Investment Authority is the sovereign wealth fund of the State of Qatar. Qatar UAE and 4 more.

Qatar Investment Authority QIA is a Sovereign Wealth Fund located in Doha Qatar Middle East and was founded in 2005. Greg Bright is executive chairman of Conexus Financial. Founded in 2005 we want to generate better jobs environments and.

Assets under management in the United Kingdom UK 2013 by parent type Total assets of closed-end funds in the US. Developed an Asset Management Sector focus with a strong network of Qatari investment managers and tax benefits to attract new asset managers and funds.

Search Home Page About Us Qia In Focus Mandate History Values Governance Climate Change Qia Ceo Board Members Investment Strategy Asset Allocation Qia In Qatar Investment Process Sectors Real Estate Infrastructure Tmt Health Care Financial

Qatar Investment Authority Company Profile Financings Team Pitchbook

Qia Announced New 10 Billion Joint Venture Fund With Citic

Qatar Investment Authority As Primary Stakeholder Sutori

Qatar Investment Authority Odoo

Euromoney Older And Wiser How Sovereign Wealth Has Responded To Covid 19

The Mystery With Sovereign Wealth Funds The Policy Times

Qatar Investment Authority To Invest Inr 3 200 Crore In Adani Electricity Mumbai Limited

Where The World S Ten Most Active Sovereign Wealth Funds Invest In Tech

Qatar Investment Authority Wiki Golden

Qatar Investment Authority Linkedin

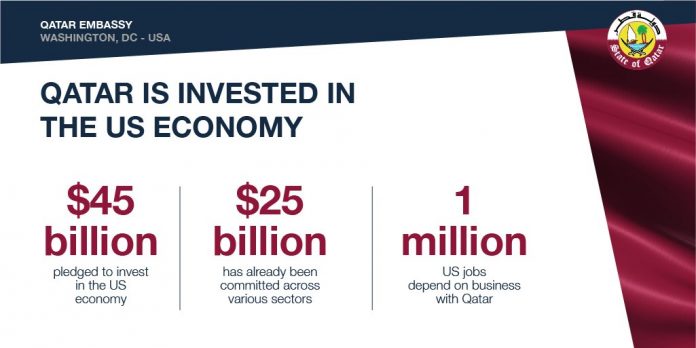

Qatar Investment Authority Aims To Reach 45 Billion In Us Investments Profit By Pakistan Today

Cash Rich Gulf Funds Hunt For Bargains As Asset Prices Plunge Financial Times

Qatar Investment Authority Plans To Increase Investments In Us To 45bn Middle East Eye

Qatar Investment Authority Qia Top1000funds Com

Pdf Gcc Sovereign Wealth Funds And Their Role In The European And American Markets

Qatar Investment Authority International Forum Of Sovereign Wealth Funds

Qatar Investment Authority And Credit Suisse Asset Management Enter Into Strategic Partnership In The Direct Lending Market

Search Home Page About Us Qia In Focus Mandate History Values Governance Climate Change Qia Ceo Board Members Investment Strategy Asset Allocation Qia In Qatar Investment Process Sectors Real Estate Infrastructure Tmt Health Care Financial